Discover how our team helped a global consumer goods corporation go from fragmented ESG data and low ratings to integrated, real-time reporting and improved sustainability performance.

Learn more in this case study on enhancing your ESG (environmental, social, and governance) tracking and boosting your sustainability ratings.

Problem 1: Fragmented Data Systems

Each global office used different platforms for ESG data collection, resulting in fragmented data that couldn’t be easily integrated or compared. Every stakeholder involved in the process was not able to get relevant information in one place.

Why it’s relevant:

Fragmented data from multiple sources(ecommerce sites, customer queries, feedback, leading trends) hindered the company’s ability to have a unified view of its ESG performance, leading to inconsistent reporting.

How we overcame it:

Experts at DataToBiz developed standardized ESG data collection templates to ensure consistency and accuracy across all global offices.

Problem 2: Manual Reporting Hazards

The company’s reliance on manual data entry for ESG metrics caused delays and inaccuracies, leading to discrepancies in quarterly reports.

Why it’s relevant:

Manual processes were time-consuming and prone to human error, affecting the reliability and timeliness of ESG reports.

How we overcame it:

Our development team created a few custom Power BI dashboards that automated data aggregation and visualization, providing real-time insights into ESG performance.

Problem 3: Complex Regulatory Set-up

ESG analytics is booming, so with current trends, regulations, and changing industry standards, the client needed help to keep up with diverse and frequently changing ESG regulations across various countries, risking non-compliance and potential fines.

Why it’s relevant:

Non-compliance with ESG regulations could result in financial penalties and damage to the company’s reputation.

How we overcame it:

We created a dynamic compliance framework tailored to the client’s global footprint, enabling them to adapt quickly to regulatory changes.

Problem 4: Underperforming ESG Metrics

The client identified gaps in key areas like carbon footprint measurement and waste management, leading to lower ESG ratings from evaluators such as GRI and SASB.

Why it’s relevant:

Low ESG ratings could affect the involved investors and external stakeholders, affecting the company’s market reputation and investment potential.

How we overcame it:

We designed targeted ESG improvement plans under our ESG tracking and sustainability analytics strategies with clear, actionable steps to address these underperforming areas.

Problem 5: Stakeholder Dissatisfaction

Investors and other stakeholders expressed vague dissatisfaction with the need for more transparency and time-framing in ESG reporting, impacting the company’s market reputation.

Why it’s relevant:

Dissatisfied stakeholders could decrease investor confidence and support, affecting the company’s reputation management.

How we overcame it:

Our team developed robust communication protocols and reporting tools to up transparency and keep stakeholders informed with timely, accurate ESG data.

Data Ingestion Layer

Data Integration Tools: ETL/ELT tools (e.g., Informatica, Talend, Airbyte) to extract data from various sources.

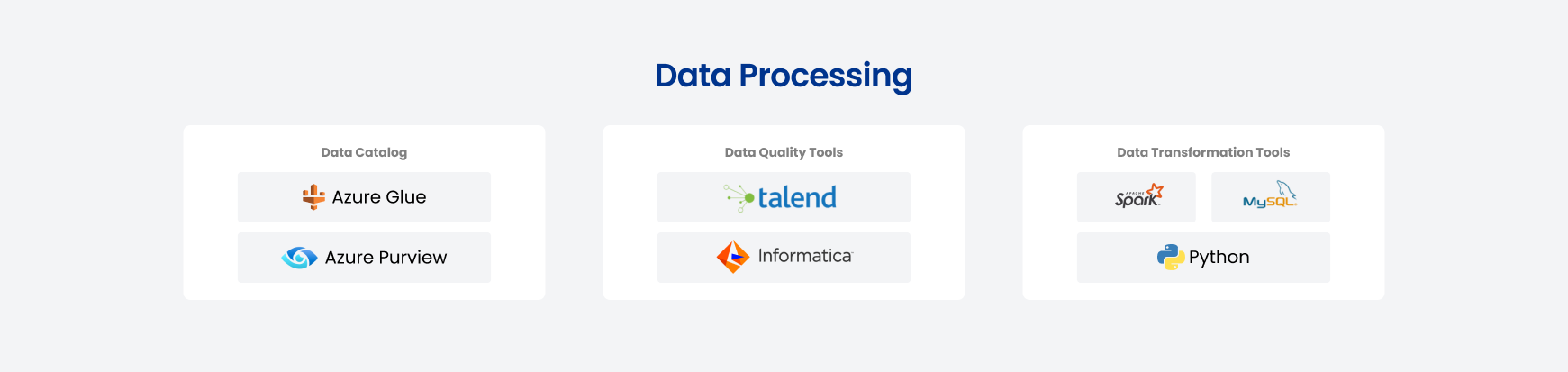

Data Processing Layer:

Data Catalog: Metadata management tool (e.g., Amazon Glue, Azure Purview) to manage data definitions and lineage.

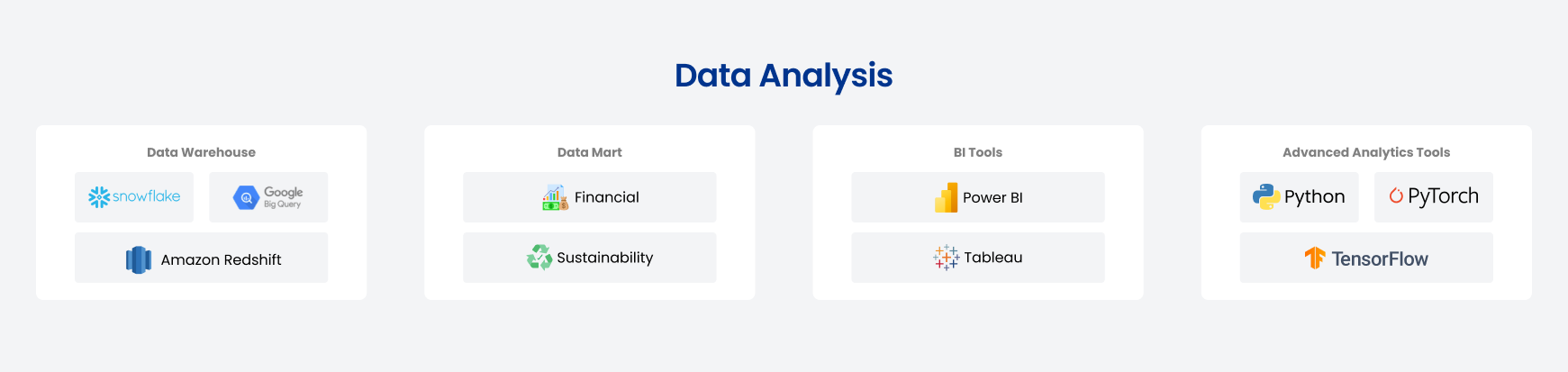

Data Analysis Layer:

ESG Compliance Layer:

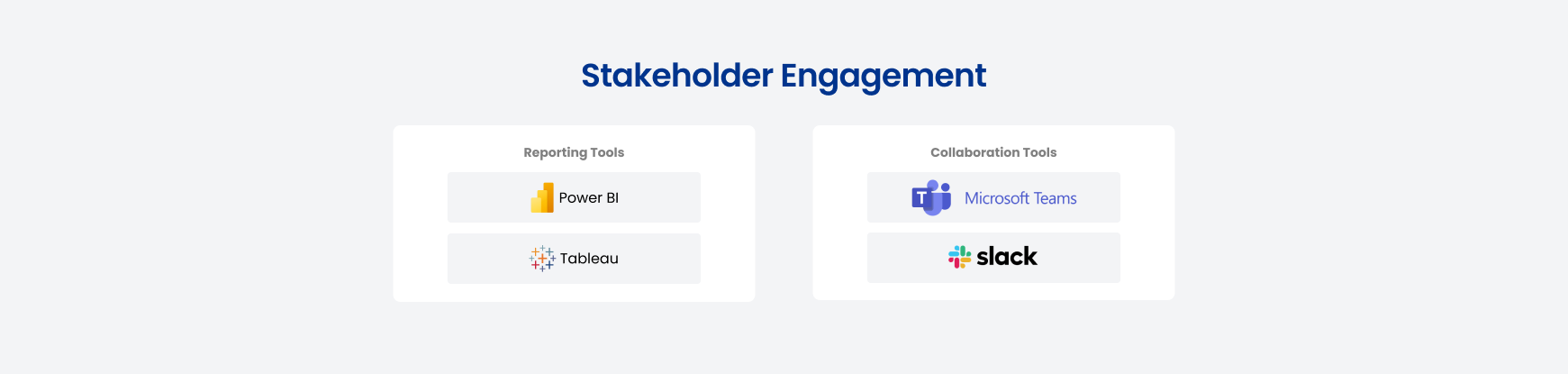

Stakeholder Engagement Layer:

Reporting Tools: Interactive reporting tools (e.g., Power BI, Tableau) for various stakeholder groups.

Collaboration Tools: Platforms for communication and collaboration (e.g., Microsoft Teams, Slack).

Consumer Goods

North America

End to End Project Lifecycle Management

Briefly describe the challenges you’re facing, and we’ll offer relevant insights, resources, or a quote.

Business Development Head

Discussing Tailored Business Solutions

DataToBiz is a Data Science, AI, and BI Consulting Firm that helps Startups, SMBs and Enterprises achieve their future vision of sustainable growth.

DataToBiz is a Data Science, AI, and BI Consulting Firm that helps Startups, SMBs and Enterprises achieve their future vision of sustainable growth.