Analyzing the stock market using artificial intelligence has been a work in progress recently. Here, we’ll discuss how you can develop an AI stock prediction model using reinforcement learning.

Analyzing the behavior of the stock market has been a subject of interest and challenge in the AI industry. Data scientists, market analysts, and financial experts have been curious to determine whether it is possible to overcome these challenges. The biggest concern is the need for an extra large dataset to build a predictive system based on supervised learning algorithms.

Furthermore, even the most advanced technologies seem to be inadequate to accurately predict the changing prices in the stock market. Yet, accurate AI stock price prediction could be possible without relying on large datasets.

In this blog, we’ll try to identify the challenges of stock market prediction and understand if we can use reinforcement learning for stock prediction and data analysis in Python, that too, using limited or no data to train the algorithm.

Before we proceed to read more about stock price prediction using machine learning, let’s understand more about the data analysis methods used to process stock market data.

The stock market data is analyzed in different techniques. These are categorized as – Time Series Analysis and Statistical Data Analysis.

A time series is defined as a sequence of data points that appear/ occur in successive order in a given period. It is the opposite of cross-sectional data, where the events that occur at a specific time point are captured.

The time series analysis tracks the movement of the chosen data points over the specified period. The data points are usually the price of the stock/ share/ security. The prices are collected at regular intervals to analyze the patterns.

There are various techniques to perform the time series analysis on stock market data. Let’s check them out in brief.

The moving average of a stock is calculated to smooth the price data and constantly update the average price. In finance, the MA (moving average) is considered a stock indicator and is used in technical analysis. The short-term price fluctuations are mitigated in this process. The MA is further divided into the following:

SMA is calculated using the arithmetic mean for a given set of values over a specific period. Here, the set of values is the stock prices. These are then added and divided by the number of prices in the set.

Formula: A1+ A2+ A3+… Ann

Here, A= average in the period; nn= number of periods; SMA= n

The EMA gives more importance to recent prices to make the average price more relevant based on the new information. The SMA is calculated first to use in the EMA formula.

The smoothing factor is calculated next to determine the weighting of EMA- 2/(selected period+1).

Formula: EMAt= [Vt×(1+ds)]+EMAy×[1−(1+ds)]

Here, EMAt= today’s EMA; Vt= today’s value; EMAy= yesterday’s EMA; ds= smoothing (number of days)

Some other types of moving averages are:

It is another approach to time series forecasting. ARIMA and exponential smoothing are widely used methods as they offer a complementary approach to the problem. ARIMA describes the auto-correlations in data, while exponential smoothing relies on seasonality in data and trend description.

This model can analyze different types of time series data for forecasting. It is a mathematical model that uses inputs from specified time series to forecast data ranges. The Box Jenkins model determines the outcomes based on the differences between data points. It identifies trends for forecasting stock prices using autoregression, moving averages, and seasonal differences.

It is a statistical technique developed to assess the magnitude and nature of data variability over a certain period. The rescaled range analysis method is used to identify and evaluate persistence, randomness, and mean reversion based on the time series data from the stock markets. This insight is used to make proper investment strategies.

It is the common value that occurs in the dataset.

It is the middle number in the dataset. For example, in 4, 6, 7, 9, and 11, the median is 7.

It is the average value of the dataset.

It is also called standard normal distribution or Gaussian distribution model. It is charted along the horizontal axis, representing the total value spectrum in the dataset. The values of half the dataset will be higher than the mean, while the other half will be longer than the mean. And the other data points will be around the mean, with a few lying on extreme/ tail ends on both sides.

It measures the asymmetry/ symmetry of the price/ data point distribution. The skewness will be zero in a standard normal distribution. A negative skewness will lead to a distorted bell curve on the left, while positive skewness will cause a distorted bell curve on the right side.

It is an area of machine learning that takes the appropriate action to maximize returns for a given situation. Many software applications and machines use reinforcement learning (RL) to identify the best behavior/ path to arrive at the desired result for a specific situation.

Reinforcement learning is different from supervised learning. In the latter, the training data is the answer key to training the model with the correct answer. However, in RL, the reinforcement agent decides which task to perform, as there is no specific answer used for training. It allows machine learning developers to train the algorithm without using a dataset. The algorithm will learn from experience and improve itself over time.

Fortunately, there are a few datasets available to train the algorithms. Developers can access the datasets from the following:

The data is available from 1st January 2000 to 31st April 2021. It provides the price history and trading volumes of the fifty stocks indexed on NIFTY 50 from the National Stock Exchange (NSE) in India. The datasets have day-level pricing and trading values for each stock. They are provided in a .cvs file with a metadata file for additional information.

Yahoo Finance has a vast collection of the latest information on trends, prices, and patterns in the global stock market.

NSE Data & Analytics Limited provides data and info-vending services. It is previously known as DotEx International Limited, a separate setup dedicated to providing datasets and analytics. The Capital Market Segment data & market quotes, Currency Derivative Market Segment (CDS), Futures and Options Segment (F&O), Corporate Data, Corporate Bond Market data and Securities Lending & Borrowing Market (SLBM), and Wholesale Debt Market Segment (WDM) data is provided in these datasets.

Python is a popular programming language. It is used to develop models in different niches and has become a go-to choice for creating algorithms for stock trading. It is an open-source package and easy to use when building complex statistical models. Python allows developers to develop their own data connectors, execute mechanisms, run backtesting, and optimize testing modules.

import numpy as npimport pandas as pdimport matplotlib.pyplot as pltimport seaborn as snssns.set()!pip install yfinance --upgrade --no-cache-dirfrom pandas_datareader import data as pdrimport fix_yahoo_finance as yffrom collections import dequeimport randomimport tensorflow.compat.v1 as tftf.compat.v1.disable_eager_execution()In this analysis, we used yahoo finance open-source data,

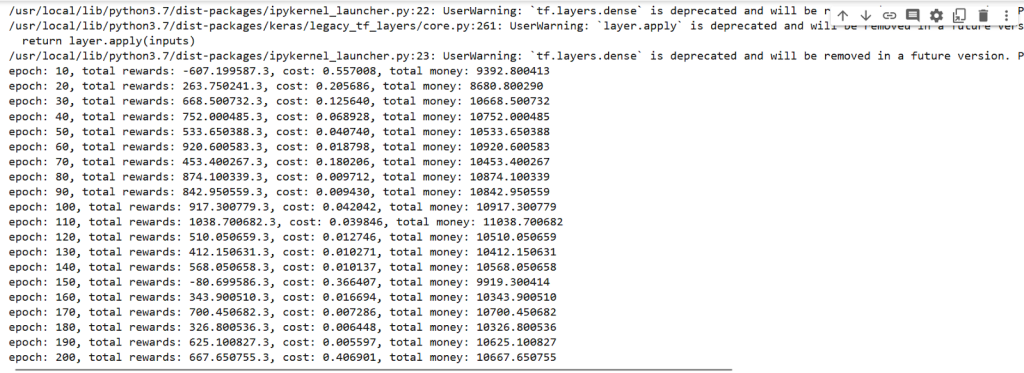

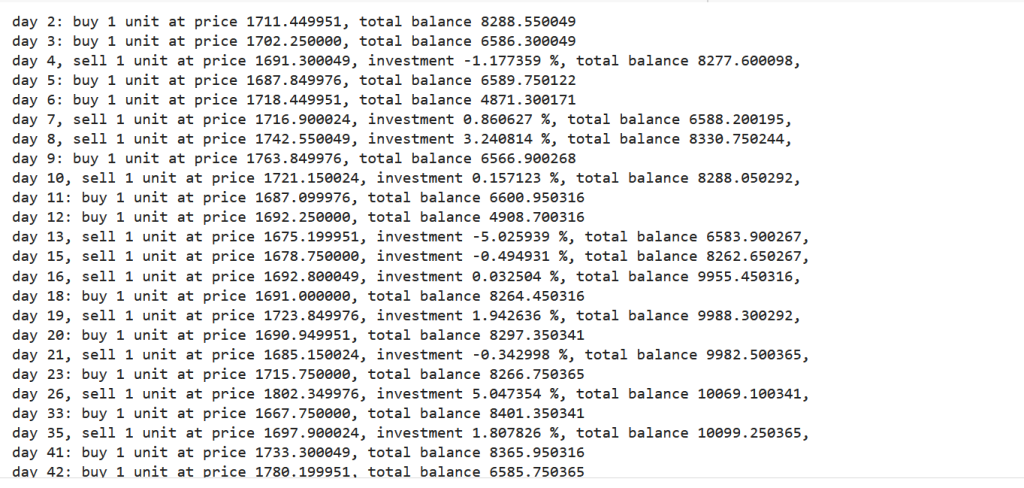

yf.pdr_override()# df_full = pdr.get_data_yahoo("FB", start="2018-01-01", end="2019-01-01").reset_index()# df_full.to_csv('FB.csv',index=False)df_full= pd.read_csv('/content/INFY.NS.csv')df_full.head()df= df_full.copy()name = 'Q-learning agent'class Agent: def__init__(self, state_size, window_size, trend, skip, batch_size): self.state_size = state_size self.window_size = window_size self.half_window = window_size // 2 self.trend = trend self.skip = skip self.action_size = 3 self.batch_size = batch_size self.memory = deque(maxlen = 1000) self.inventory = [] self.gamma = 0.95 self.epsilon = 0.5 self.epsilon_min = 0.01 self.epsilon_decay = 0.999 tf.reset_default_graph() self.sess = tf.InteractiveSession() self.X = tf.placeholder(tf.float32, [None, self.state_size]) self.Y = tf.placeholder(tf.float32, [None, self.action_size]) feed = tf.layers.dense(self.X, 256, activation = tf.nn.relu) self.logits = tf.layers.dense(feed, self.action_size) self.cost = tf.reduce_mean(tf.square(self.Y - self.logits)) self.optimizer = tf.train.GradientDescentOptimizer(1e-5).minimize( self.cost ) self.sess.run(tf.global_variables_initializer()) defact(self, state): if random.random() <= self.epsilon: return random.randrange(self.action_size) return np.argmax( self.sess.run(self.logits, feed_dict = {self.X: state})[0] ) defget_state(self, t): window_size = self.window_size + 1 d = t - window_size + 1 block = self.trend[d : t + 1] if d >= 0else -d * [self.trend[0]] + self.trend[0 : t + 1] res = [] for i inrange(window_size - 1): res.append(block[i + 1] - block[i]) return np.array([res]) defreplay(self, batch_size): mini_batch = [] l = len(self.memory) for i inrange(l - batch_size, l): mini_batch.append(self.memory[i]) replay_size = len(mini_batch) X = np.empty((replay_size, self.state_size)) Y = np.empty((replay_size, self.action_size)) states = np.array([a[0][0] for a in mini_batch]) new_states = np.array([a[3][0] for a in mini_batch]) Q = self.sess.run(self.logits, feed_dict = {self.X: states}) Q_new = self.sess.run(self.logits, feed_dict = {self.X: new_states}) for i inrange(len(mini_batch)): state, action, reward, next_state, done = mini_batch[i] target = Q[i] target[action] = reward ifnot done: target[action] += self.gamma * np.amax(Q_new[i]) X[i] = state Y[i] = target cost, _ = self.sess.run( [self.cost, self.optimizer], feed_dict = {self.X: X, self.Y: Y} ) ifself.epsilon >self.epsilon_min: self.epsilon *= self.epsilon_decay return cost defbuy(self, initial_money): starting_money = initial_money states_sell = [] states_buy = [] inventory = [] state = self.get_state(0) for t inrange(0, len(self.trend) - 1, self.skip): action = self.act(state) next_state = self.get_state(t + 1) if action == 1and initial_money >= self.trend[t] and t < (len(self.trend) - self.half_window): inventory.append(self.trend[t]) initial_money -= self.trend[t] states_buy.append(t) print('day %d: buy 1 unit at price %f, total balance %f'% (t, self.trend[t], initial_money)) elif action == 2andlen(inventory): bought_price = inventory.pop(0) initial_money += self.trend[t] states_sell.append(t) try: invest = ((close[t] - bought_price) / bought_price) * 100 except: invest = 0 print( 'day %d, sell 1 unit at price %f, investment %f %%, total balance %f,' % (t, close[t], invest, initial_money) ) state = next_state invest = ((initial_money - starting_money) / starting_money) * 100 total_gains = initial_money - starting_money return states_buy, states_sell, total_gains, invest deftrain(self, iterations, checkpoint, initial_money): for i inrange(iterations): total_profit = 0 inventory = [] state = self.get_state(0) starting_money = initial_money for t inrange(0, len(self.trend) - 1, self.skip): action = self.act(state) next_state = self.get_state(t + 1) if action == 1and starting_money >= self.trend[t] and t < (len(self.trend) - self.half_window): inventory.append(self.trend[t]) starting_money -= self.trend[t] elif action == 2andlen(inventory) >0: bought_price = inventory.pop(0) total_profit += self.trend[t] - bought_price starting_money += self.trend[t] invest = ((starting_money - initial_money) / initial_money) self.memory.append((state, action, invest, next_state, starting_money < initial_money)) state = next_state batch_size = min(self.batch_size, len(self.memory)) cost = self.replay(batch_size) if (i+1) % checkpoint == 0: print('epoch: %d, total rewards: %f.3, cost: %f, total money: %f'%(i + 1, total_profit, cost, starting_money))close = df.Close.values.tolist()initial_money = 10000window_size = 30skip = 1batch_size = 32agent = Agent(state_size = window_size, window_size = window_size, trend = close, skip = skip, batch_size = batch_size)agent.train(iterations = 200, checkpoint = 10, initial_money = initial_money)Output:

close = df.Close.values.tolist()initial_money = 10000window_size = 30skip = 1batch_size = 32agent = Agent(state_size = window_size, window_size = window_size, trend = close, skip = skip, batch_size = batch_size)agent.train(iterations = 200, checkpoint = 10, initial_money = initial_money)Output:

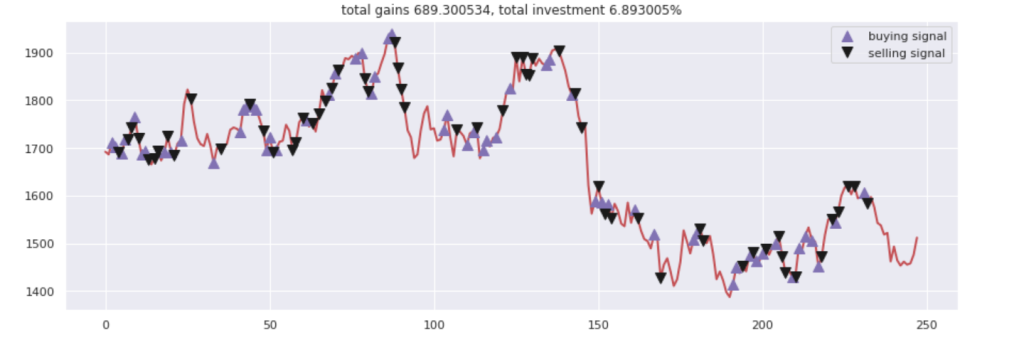

fig = plt.figure(figsize = (15,5))plt.plot(close, color='r', lw=2.)plt.plot(close, '^', markersize=10, color='m', label = 'buying signal', markevery = states_buy)plt.plot(close, 'v', markersize=10, color='k', label = 'selling signal', markevery = states_sell)plt.title('total gains %f, total investment %f%%'%(total_gains, invest))plt.legend()plt.savefig(name+'.png')plt.show()

You can always hire artificial intelligence solution providers to develop stock price prediction models using regressive learning. The models will learn and improve themselves as you continue to feed data and use them for predictions.

The day is not far when AI engineers develop an accurate stock predictor to forecast the upcoming changes in prices to help investors make better decisions. This also helps with risk management and minimizing the after-effects of a market crash in case of global calamities.

Stock Market: A stock market contains several exchanges like the NASDAQ, the New York Stock Exchange, etc. Stocks are listed on the exchange and available for buyers and sellers to make a transaction.

The exchange is a place that brings buyers and sellers together to share, trade, sell, and buy stocks. It also monitors the demand and supply of each stock and the subsequent changes in the price of the stock. A stock is a share released by a company available to the public for purchase/ selling.

In simple terms, the stock market is a collection of exchanges that facilitate the buying and selling of shares listed by companies. The transactions happen formally as the OTC (over-the-counter) marketplaces are guided by strict regulations. The stock market is interchangeably used with the term stock exchange. Traders can buy or sell the stock on one or many exchanges.

Broker: A person who acts as a third party between the buyer and seller. Many traders rely on stock brokers to complete the transactions on the exchanges.

Bid: It is the amount you intend to/ are willing to pay for a stock listed on the exchange.

Buy: It implies the act of buying shares of a company or taking a position in it.

Sell: Handing over your stock in exchange for money. It also refers to cutting losses by getting rid of stock with decreasing prices.

Bull: It is a stock market trend/ condition where the prices are expected to rise high.

Bear: It is the opposite of bull and a condition of the stock market where the investors expect the prices to fall.

Portfolio: A collection of financial investments a person owns.

Exchange: A marketplace where different stocks and investments are traded.

Going Long: It refers to placing a bet on the stock price that will increase. This allows you to buy for less (low) and sell for a higher price.

Volatility: It is the frequency with which the stock prices move up or down. Stock markets have high volatility as the prices change fast.