Customer analytics is the process of understanding customers to streamline banking products and services. It is also an integral part of banks’ strategies to achieve their goals and increase revenue. Check out the role and effectiveness of customer data analytics in the banking industry.

The banking sector is moving from the product-centric model to a customer-centric model. The changing socio-economic scenario around the globe has pushed banks and financial institutions to reassess their traditional systems and make the necessary changes to stay relevant in the current market.

Banks face the risk of decreasing revenue and increasing expenditure due to the reducing interest rates, defaulters, and competition from other banks. But there’s one thing that can help banks overcome the challenges and create a strong customer base with loyal customers.

Customer analytics is the analysis of customer data to understand their requirements and specifications. From attracting new customers to retaining existing customers and detecting risky leads, bank data analytics helps in financial product development, streamlining processes, and making the bank a customer-friendly establishment.

Every industry uses data analytics, and the financial sector is no exception. Data analytics is the practice of analyzing data to derive insights and predictions that help in decision-making. Many banks have begun the process of digital transformation by adopting the data-driven model to make decisions based on accurate and real-time data reports.

Data analytics in banks helps the management and the chief executives optimize the resources and streamline operations to maximize returns. The aim is to increase the capabilities and efficiency of the bank without increasing expenditure. Since banks have access to multiple sources to collect customer data, it is easy to run analytics and derive insights by using the right tools.

When banks know customers’ spending patterns, credit card usage frequency, investment preferences, and so on, they can provide financial products and services that align with what customers want. Risk analysis is another aspect banks take seriously. Knowing the probability of a customer turning into a defaulter will help determine if the bank can provide them with a loan or not.

We can summarize that data analytics in banking is used for demand, supply, and risk management purposes, and customer data plays a vital role in these analytics.

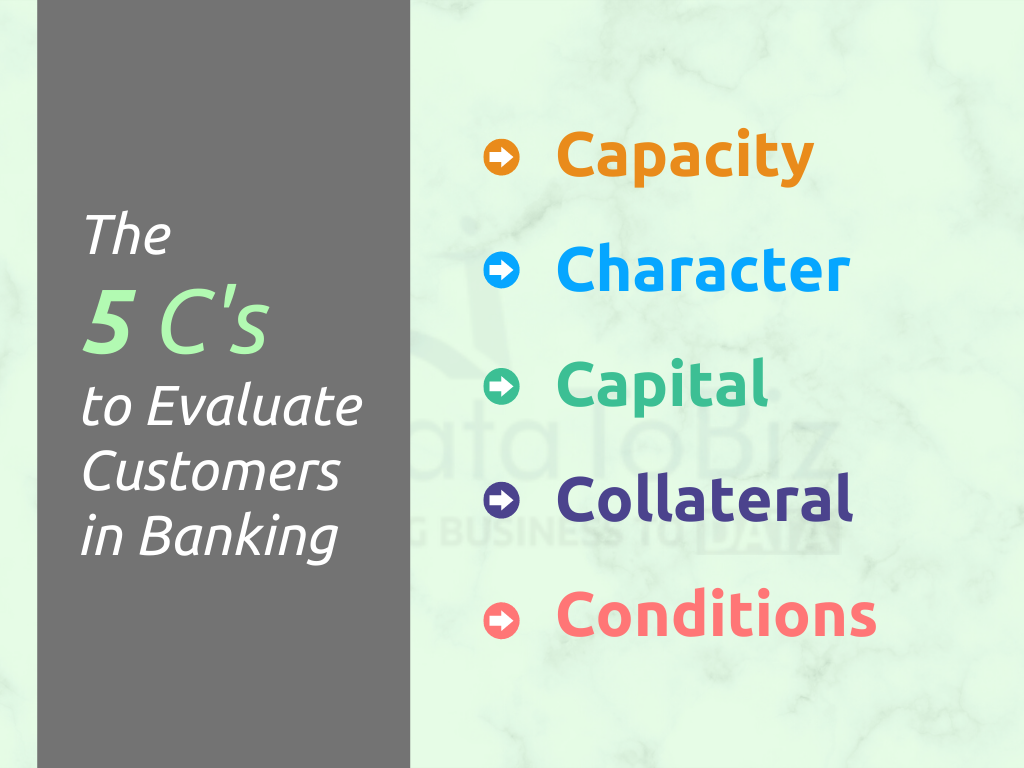

Banks use 5 C’s to evaluate customers- Capacity, Character, Capital, Collateral, and Conditions. These factors are primarily considered to assess the creditworthiness of a prospective customer.

Details like credit score, loan history, repayment patterns, income, expenditure, etc., are collected and analyzed to evaluate the lifetime value of a customer. Various tools like Microsoft Power BI and Tableau are used to run data analytics and assess the worthiness of customers.

Banking data analysis uses modern business intelligence tools to process historical and present data in real-time. Using the latest technology ensures that the employees and management can access the reports in minutes instead of waiting for weeks and months. This increases the accuracy of the reports and helps in making the right decisions.

Customer analytics includes analyzing the financial and behavioral patterns in the target market to have a comprehensive idea about customers’ preferences and tendencies. Understanding customers will help understand the market trends and be prepared to grab new opportunities.

Banks need to acquire new customers regularly to keep the income flowing. However, it is important to know who the customers are and what they want. Data analytics helps in creating banking customer segments based on several factors such as demographics, income sources, spending ability, etc. By categorizing customers into specific individual segments, banks can create financial products for each category and plan marketing strategies to promote the right product/ service to the right category.

Banks also need to consider customer response to the marketing campaign and the financial product/ service to determine if they are on the correct path to achieve their goals. Fraud detection is another aspect at this stage. Does the bank want to take the risk of acquiring a customer who is likely to commit fraud or become a defaulter? This helps in filtering the prospective leads to avoid risky customers and focus on those who bring value to the establishment.

Customer insight is an interpretation of the trends in customer behavior. It provides banks with the necessary information to understand whether or not the target customer segment will like the product/ service offered to them. It helps customize the financial products and schemes to suit the target market based on their reactions/ behavior.

Banks can get customer insights through different ways like asking for feedback, conducting surveys, creating focused groups, collecting data from browsers, and so on. This data is housed in a centralized database and processed to derive insights. Various analytical and statistical methods are used for this purpose.

The customer analytics dashboard helps employees in managing the day-to-day customer experience. For example, banks use Power BI to create financial dashboards that share actionable insights and reports in real-time. Employees can click on the intuitive dashboard to get the macro and micro view of the customer to determine the best possible way to take the issue forward.

By providing customers with what they want, banks can enhance customer experience and inspire brand loyalty. A crucial aspect of customer experience is the personalization of products and services. Make customers feel special by offering them a personalized financial product or scheme that suits their requirements.

Banks and financial institutions are no strangers to marketing and advertising. But with an increasing focus on digital marketing, it is vital to create an elaborate marketing plan based on the target market and customer perspectives.

Building a brand image is necessary for banks to establish themselves as reliable and trustworthy financial service providers. The marketing strategies should be customized for each segment to increase customer response and participation. From choosing the right message to identifying the right channel for communication, customer analytics provides banks with the required data to formulate effective marketing strategies and implement them with care.

Sales forecasting is one area where many businesses and banks tend to end up with inaccurate results. It is rather challenging to assess the impact of an individual customer on the overall result. Moreover, manually handling this process is labor-intensive and time-consuming. The data would long become outdated by the time the forecasting is complete.

Bank customer analytics helps in automating sales forecasting and scaling the process to suit the bank’s volume of business. Automation provides more accuracy and practicality to the approach. Automation requires the use of artificial intelligence and machine learning technologies where data is continuously collected, cleaned, processed, and stored to run analytics as per the predetermined parameters.

How do banks measure customer loyalty? What if the customer doesn’t respond to survey questions or provide feedback on products/ services? Analytics help create a predictive model that uses customer and bank data (historical and real-time) to assess the loyalty of a customer. Banks can train predictive machine learning models on datasets to identify patterns and highlight trends that are likely to inspire customer loyalty or send the customer to the competitor.

Advanced analytics are required to get accurate predictions. Social media analysis is also helpful in predicting customer loyalty. For example, Kueski is a Latin American online lending company that uses social graphs, credit history, and online information to decide the creditworthiness of an applicant. Banks can thus follow different approaches to promoting loyalty in the target market.

Struggling to reap the right kind of insights from your business data? Get expert tips, latest trends, insights, case studies, recommendations and more in your inbox.

You can understand the reasons for customer churn and provide insights to increase customer retention as part of deliverables with Data analytics for banking services. Artificial intelligence models can be used to process customer information, feedback, and survey results to identify the reasons for customers leaving the bank.

By working on this information, banks can strengthen the weak points and streamline products/ services to reduce customer churn and increase the retention rate. The customer service department and front-end employees can be empowered to focus on customer retention by offering personalized services.

Customer analytics for banking firms can provide solutions to enhance customer experience and promote brand loyalty. Here are some ways to improve customer services in banks and financial institutions:

DataToBiz is a data analytics solution provider with expert analysts who works with various business establishments in different industries. We offer offshore banking analytical services through tools like Power BI & Tableau. Talk to our team to implement customer analytics in your bank and streamline the internal processes to enhance customer experience and increase revenue.